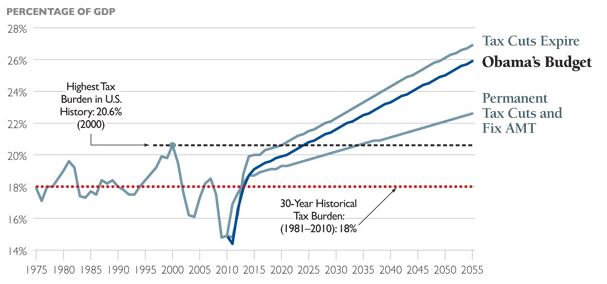

Unprecedented Tax Hike in 2013: January 1, 2013 marked the beginning of some of the largest tax increases in US history. In a single year, Americans faced a $494 billion tax increase, the highest ever in one year. The average American household experienced tax increases by $3,800 in 2013 alone. Taxpayers are now seeing even higher tax rates in succeeding years.

Luckily, we have 30 years of experience in educating our clients about their reduced tax, or tax-free, retirement and investment options. To learn more about our solutions to your tax heavy retirement, click here.

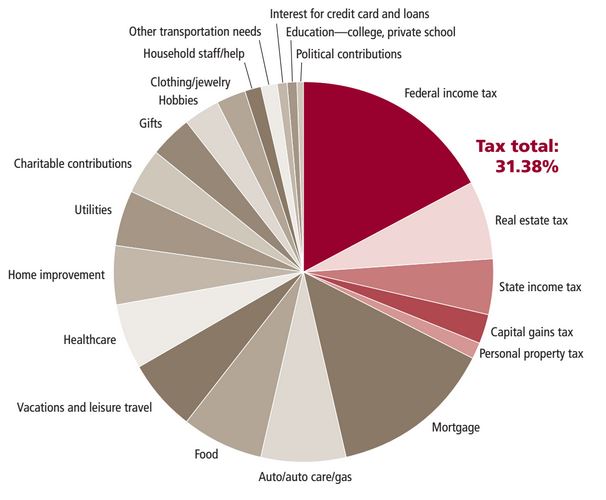

Today taxes stand as our retiring seniors’ largest expense. On average, you can expect to pay nearly 31.38% of your retirement spending on taxes alone. Even the slightest elevation will have a significant impact on your retirement. Furthermore, now that our baby boomers are reaching retirement age, along with the recent Obamacare policy adoption, taxpayers are facing an astronomical social security obligation. To fill the gap the federal government will have no choice but to further increase your taxes. Below are the results of a recent study done by Lincoln Financial Group (LFG) on overall spending in retirement.