Municipal Bonds

Most financial professionals agree: The best way to reach a financial goal is with a diversified portfolio that includes stocks, bonds, and contractual wealth accumulation vehicles. But with so many different types of bonds available, how do you know which ones make the most sense for your portfolio? Unlike other types of bonds, municipal bonds are unique because the interest paid to bondholders is generally free from regular federal income tax and, in many cases, state and local income taxes.Because stocks and bonds generally have a low correlation to one another, when stocks “zig,” bonds tend to “zag.” By allocating between both assets you can help lower the overall risk of your portfolio, while maintaining some of the upside potential of stocks. Please remember, past performance does not guarantee future results.

All investments involve risks, including possible loss of principal. Municipal bonds are affected by interest rate movements. Municipal bond prices, and thus, a tax-free income fund’s share price,generally move in the opposite direction of interest rates. As the prices of the municipal bonds in a fund portfolio adjust to a rise in interest rates, the fund’s share price may decline.

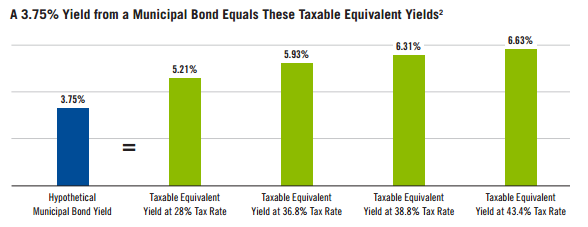

Tax Advantages Result in Higher Returns

On a taxable equivalent basis, municipal bonds may offer yields that are higher than taxable fixed income alternatives. The taxable equivalent yield shows how much more you would have to earn from a taxable bond to compensate for taxes in order to equal the yield of a tax-free municipal bond.

Fixed Indexed Annuities

Fixed index annuities provide the guarantees of fixed annuities, combined with the opportunity to earn interest based on changes in an external market index. But because you’re not actually participating in the market, the money in your annuity (your “principal”) is not at risk.A fixed index annuity is a great choice if you want the opportunity for accumulation, but don’t want to risk losing any money within the market. Annuities accumulate on a tax-deferred basis. Basically, this means you will not pay taxes on the money that enters the account until it is distributed at the selected distribution date. This is advantageous because the money that accumulates credited interest within the account will have a higher principle than if it were pre-taxed.

With Fixed Index Annuities you receive:

- Principal protection

- Tax-deferred growth

- One or more index allocation options

- A choice of crediting methods

- Income options, including income for life

- Death benefit options

- Optional benefits that may help protect your retirement assets and income (available at an additional cost)